NOTE FROM EDITOR: This content honors Compassion’s historical work in India. While we no longer have an India sponsorship program, we are grateful for the lives changed and meaningful work achieved through our sponsors and donors in our nearly 50 years there. For a detailed explanation of the end of our sponsorship program in India, please visit: compassion.com/india-update.

In this century of innovation and technological breakthroughs, it’s hard to imagine not having access to a bank account, credit source, health insurance or a safe place to keep our hard-earned money. But that is a daily reality for the majority of people living in developing countries like India.

Forty-two percent of India’s population doesn’t have a bank account; in rural areas, it’s 61 percent.

Poverty, illiteracy, lack of awareness about banking and financial services, and the government’s welfare programs continue to keep India’s rural population off the country’s economic map. This is not because banks aren’t available in rural areas, but because banks are unable to process these people’s applications due to insufficient documentation.

Hence, most families store their earnings under mattresses or in containers, from which it can be easily stolen or taken to be spent on unnecessary things.

The majority of people who live in poverty resort to unreliable sources of credit, such as chit funds (a kind of savings practiced in India) to keep their hard-earned money secure. They also use local money lenders to aquire loans for various needs, such as farming, health care, family crises, marriages and celebrations.

Money lending is a practice in Indian villages that has been around for centuries. Due to the lack of financial services in villages, small farmers turn to local money lenders, who charge high interest rates that vary from lender to lender. If their crops fail or they have low production, the farmers still have to repay the loans they took. Further lending by the farmers for next year’s cultivation draws them deeper into debt.

As this cycle continues year after year, it slowly drags these farmers into a vicious cycle of debt from which they can never manage to recover. Such situations have triggered several suicidal deaths in India’s agricultural sector over the last few years.

In an emerging economy like India’s, financial inclusion is critical to national progress. Financial inclusion involves both access to financial products and knowledge about their fairness and transparency. Yet, due to a lack of adequate information and understanding about the financial and banking industries, the marginalized often remain left out.

In 2014, to address the financial disparity in India and to include rural households in banking services, Prime Minister of India, Narendra Modi, launched an ambitious plan titled ‘Pradhan Mantri Jan Dhan Yojana’ (PMJDY) or ‘Prime Minister’s People Wealth Plan.’ This plan aimed to connect the poorest citizens of the country with bank accounts and associated banking services, to help them achieve economic freedom.

Surya is a local partner of a Compassion Child Development Center (CDC) in Odisha’s western province. Soon after the commissioning of the PMJDY plan in 2015, Surya organized a meeting with the CDC Advisory Team, parents of children in the program and community residents. During this meeting, the parents learned about the new plan and it’s various benefits.

These benefits include zero balance facility, life insurance coverage of 30,000 Indian rupees, free accidental insurance coverage of 100,000 rupees, debit card facility, and easy money transfer anywhere across India. The account holder could also take a loan of 5,000 rupees from the bank six months after opening the account.

“The PMJDY is a good initiative; it has opened up several opportunities for our beneficiaries’ parents who are otherwise primarily dependent on money lenders and who are often exploited by them,” Surya says.

During the meeting, Surya urged every participant to foresee a bright future with economic freedom, which could become a reality for them and change the trajectory of their lives. He further encouraged them to make use of the opportunity and open bank accounts in their individual names, as that could help them tap into the government’s resources and welfare programs in future.

After the meeting with more than 200 participants, 160 parents came forward and gave their names to open bank accounts. The CDC’s presence in the community and the outcomes of Compassion’s programs have earned the local partner appreciation from government officials at both the village and district levels.

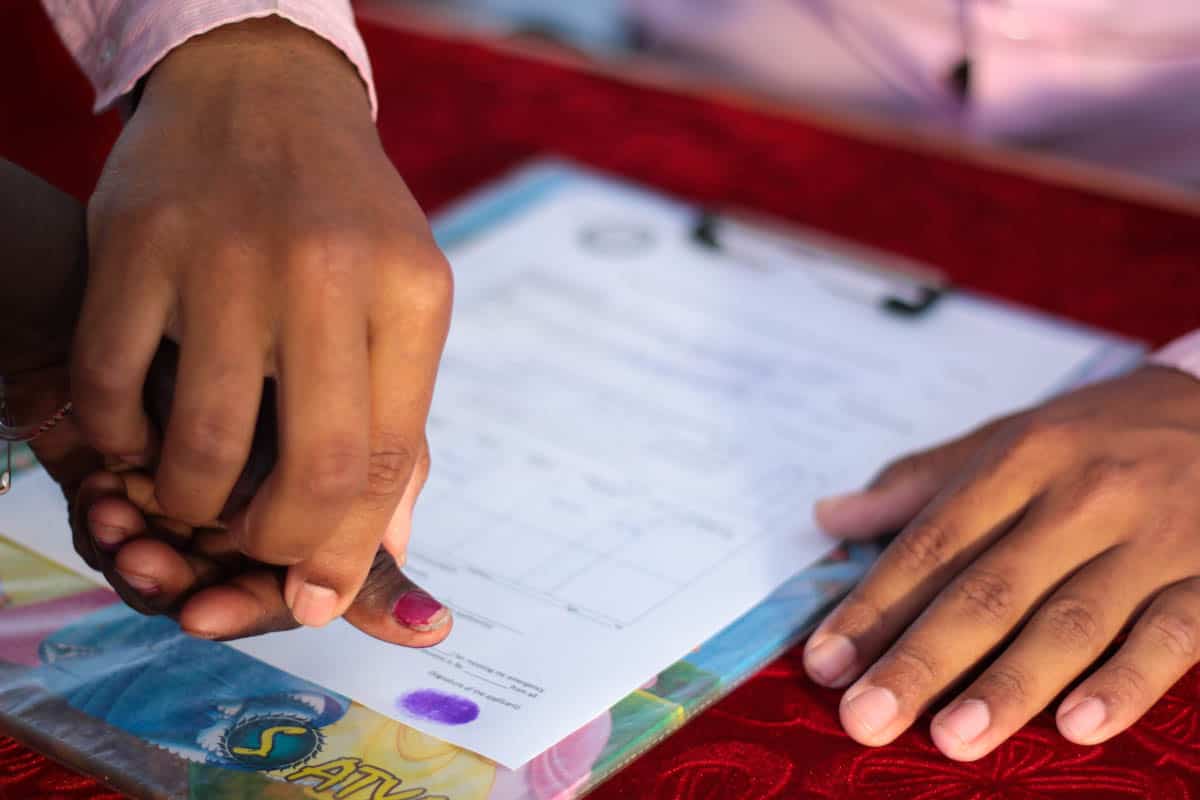

Before the inception of the PMJDY plan, opening a bank account wasn’t easy, because it required numerous documents and a minimum balance to keep the account running. Under the new plan, a single proof of identity is sufficient.

When asked about their previous experiences with opening bank accounts, the parents expressed the struggles they faced.

Sabitri, mother of a child in the Compassion program says:

“Due to lack of identity proof and a letter of recommendation from the local municipal councilor, the bank officials said they couldn’t open an account for me.”

Alcoholism among men is a challenging issue in this community. Women work hard to manage their homes by working as housemaids and daily laborers because their husbands do not contribute to their households properly. Often, small savings from their meager income is also forcefully taken away by their husbands to buy alcohol.

Bank accounts may not solve the issue of alcoholic husbands, but it will definitely help women protect their hard-earned money. It will also prevent families from taking loans from local moneylenders; instead, they can get loans from banks at much lower interest rates. They will be able to build assets, become less vulnerable to exploitation, and have opportunities for wealth creation by tapping into the services made available to them.

With the help of a passbook, the parents can now track how much money is in their account. Earlier, when villagers tried to acquire any subsidy or benefit from a government welfare program, the designated amount never reached their hands, due to the presence of unscrupulous middlemen who usurped a certain percentage of the actual benefit as their remuneration before it finally reached the benefactor.

CDC Manager, Sunil, says:

“This plan will help the government pay rural people their welfare benefits directly into their accounts, thus cutting through layers of corruption and exploitation of the poor by middlemen.”

Eight months into the PMJDY, many parents affirmed that, after opening bank accounts, they have been able to save money in a more organized way than before. Having learned to operate accounts on their own, they have gained self-confidence.

“Thank you to the center staff for taking the initiative to educate us about the concept of saving money and opening a bank account. My husband and I are able to save 1000 rupees in the bank every month for six months. This was money we ended up spending casually before, with nothing to fall back on during our crises,” says Sonamati.

“I make local cigarettes for a living, but my husband used to snatch whatever little I earned. Now, I don’t have to worry about how to hide my income from my husband, because I can keep it safe in the bank,” says Majita.

“I have received a debit card and learned from CDC staff how to use it. The card enables me to withdraw money whenever I need it from any electronic money kiosk (an ATM) without having to visit the bank,” says Gayatri.

Educating the parents of children in our program about proper saving practices and opening bank accounts was aimed to provide an opportunity for them to develop themselves – a first step toward empowering them.

Now, through quarterly meetings and home visits, the CDC staff members are trying to motivate the mothers to form Self-Help Groups (SHGs). By forming SHGs, these mothers would then be able to acquire loans from their respective banks to invest in various micro-enterprise and income-generation activities, leading to economic independence and a secured future.

0 Comments |Add a comment